$1.8M+

Revenue

236%

YoY Growth

1.7M+

Raised

Quick Overview

Breaking news:

The New Jersey Economic Development Authority (NJEDA).

Just committed another $500,000 to Dopple.

That means New Jersey isn’t just backing our vision,

it’s doubling down on it.

Why Investors Are Paying Attention

Backed by Top VCs

Jeremy Liew (first investor in Snapchat, Affirm, and The Honest Company) has invested in Dopple.

Government-Backed Matching

For every dollar you invest directly into Dopple’s Regulation D round, New Jersey matches it 1-for-1.

That’s 2× leverage on your investment.

Reduced Downside Risk

NJ’s matching funds and incentives create a safer structure for accredited angels.

Guaranteed 40 % Return via Tax Credit or Rebate

Every investor receives a 40 % rebate or tax credit 18 months post-investment.

How It Works

1. Your risk is

lower

You invest $20,000 in

Dopple’s Reg D round.

2. Your capital is leveraged

New Jersey adds $20,000 in matching funds, total $40,000 fueling Dopple’s growth.

3. Your upside

stays the same

In 18 months, you receive $16,000 back as a rebate or tax credit.

Why Dopple?

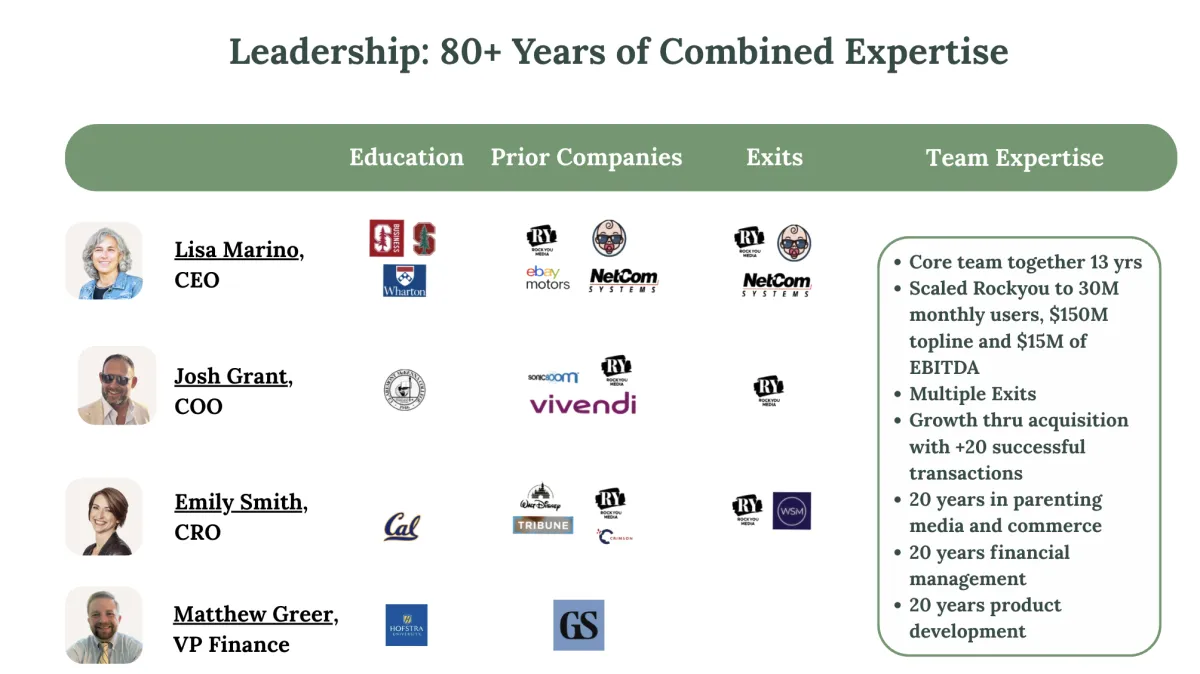

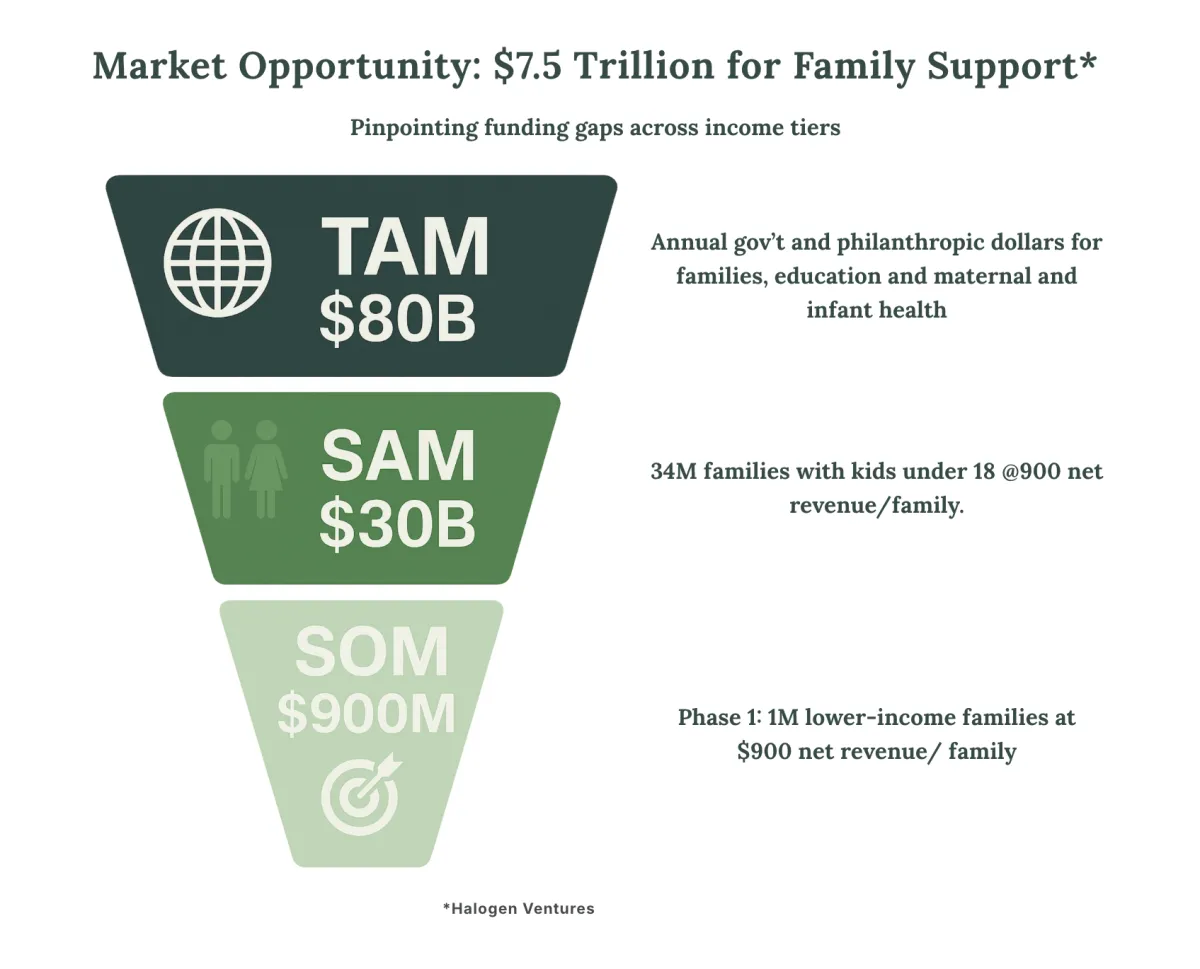

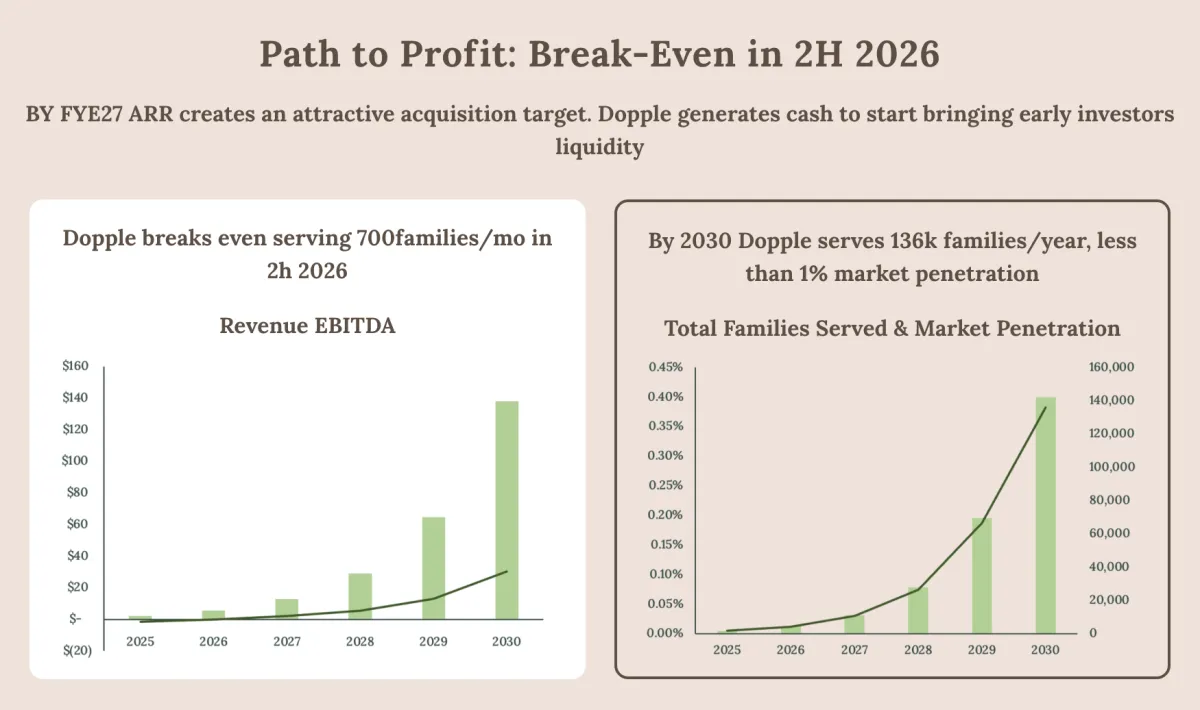

Dopple is a fast-growing fintech helping families fund their most essential needs: childcare, education, and healthcare.

We’ve already raised $1.7 million from top Silicon Valley investors and the State of New Jersey.

Now we’re inviting a small group of accredited investors to join this exclusive round.

Schedule a Call with Lisa (Founder & CEO)

Talk directly with Lisa about Dopple’s traction,

growth plan, and the NJ matching-fund program.

Spots are limited — book your 15-minute call below.

Disclaimer

This webpage is maintained by Dopple for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any securities.

Any offering of securities will be made only through the official campaign page hosted on Wefunder, a funding portal registered with the U.S. Securities and Exchange Commission (SEC) and a member of the Financial Industry Regulatory Authority (FINRA), pursuant to Regulation Crowdfunding (Reg CF).

Dopple and Wefunder do not provide investment advice or make investment recommendations. Investing in startups and early-stage companies involves a high degree of risk, including the loss of your entire investment, and is not suitable for all investors.

Such investments are speculative, illiquid, not bank deposits, not insured by the FDIC, and are not guaranteed by any governmental or financial institution.

Prospective investors should carefully review all offering materials and legal disclosures provided on the Wefunder platform before making any investment decision, and are strongly encouraged to consult their own legal, tax, and financial advisors.

Past performance is not indicative of future results, and there is no guarantee of any return on investment.